Good morning and welcome to those of you here in person, and to those on the call-in line. I’d also like to acknowledge our board of directors, key staff and consultants in attendance or online today. My name is Andrew Dahl, and I currently serve as president and chief executive officer of ZIVO Bioscience, a fully-reporting public company trading in the OTC market.

Before proceeding further, I must advise you that this report and any Exhibits to it contain forward-looking statements that involve risks and uncertainties. These statements reflect the Company’s future plans, objectives, expectations and intentions, and the assumptions underlying or relating to any of these statements. These statements may be identified by the use of the words “anticipate,” “expect,” “estimate,” “intend,” “believe,” and similar expressions. The Company’s actual results could differ materially from those discussed in these statements. Factors that could contribute to these differences include, but are not limited to, those discussed in this report.

In the 12 months since our last shareholder meeting, the Company has focused on capital funding activities for the ZIVO research I’m pleased to report that this year has seen a significant increase in funding, such that we have been able to spend much less time fundraising and more time activating the pharma and food side of the ZIVO enterprise. We’re moving forward.

For those of you unfamiliar with mission of ZIVO Bioscience, the Company holds significant intellectual property in the form of bioactive compounds, patented applications and processes, an optimized algal strain, and nutritional products derived from our proprietary algal biomass that can find their way into food, feed, supplements and even therapeutics.

Last year, we unveiled the food and feed side of the value creation strategy, positioning the algal biomass itself as a valuable product. Some of you were here to sample the vegan protein power drink concept. We continue to work on new product concepts.

On the therapeutic side, we’re conducted various experiments and studies over the past few years to support claims for healthy immune response in humans and animals, joint health and a healthy cholesterol balance. Our pharma research has focused primarily on bovine mastitis, an inflammation of the udder that impacts milk production and is responsible for nearly $3 billion in annual losses to US dairy producers and billions more worldwide.

The bovine mastitis research is in its final phase of research and funded. Per our option collaboration agreement, we are to conduct in vivo testing under the direction of Dr. Alfonso Lago at the Dairy Experts facility in Tulare County, California, furnish the active compounds plus statistical analysis of the results. We’re expecting results from Dairy Experts in the next 60 days.

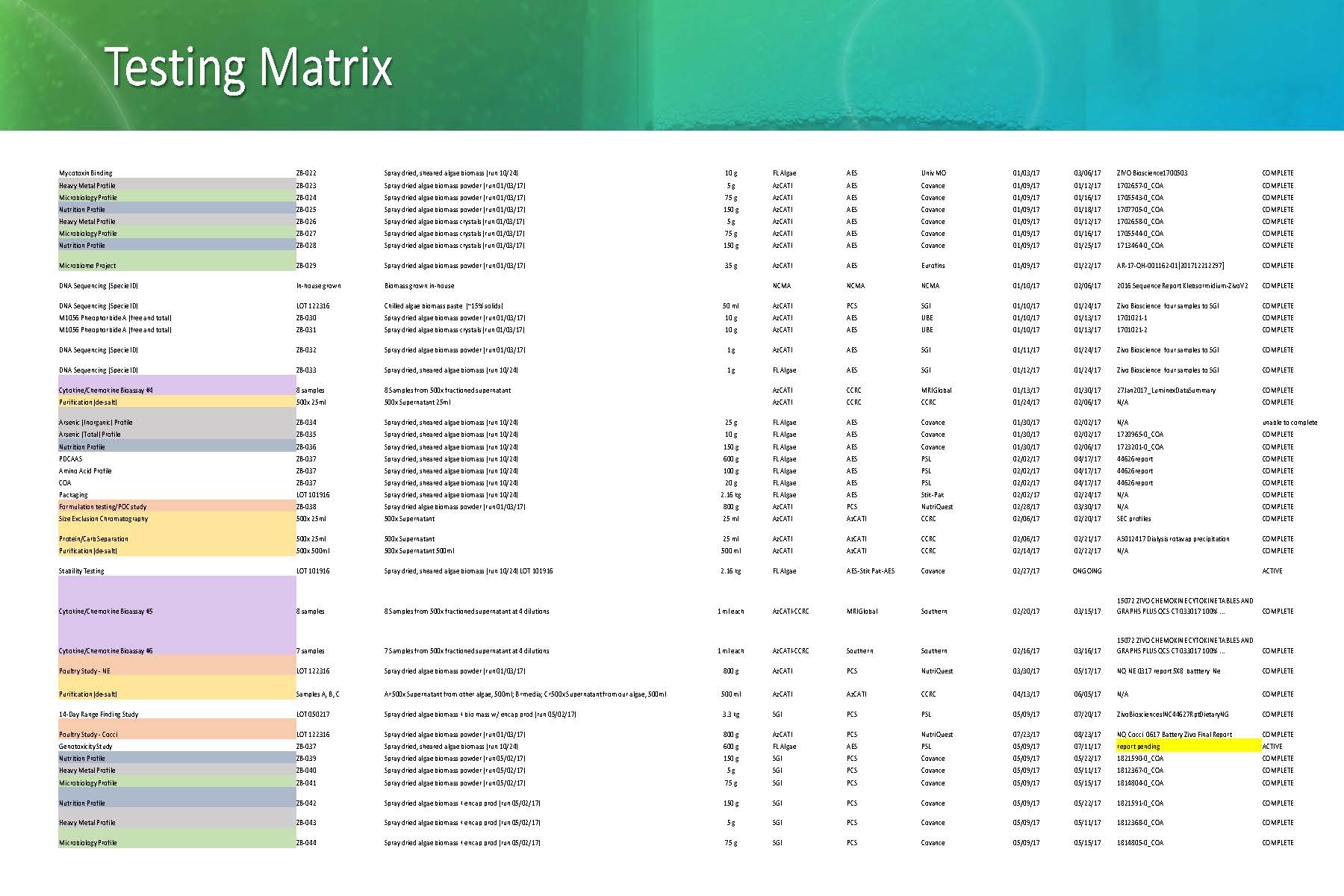

To keep that research going, we need to grow the algae in sufficient volume to supply samples for the dozens of tests, experiments and studies we are doing. This is a snapshot of a single 6-month period of testing.

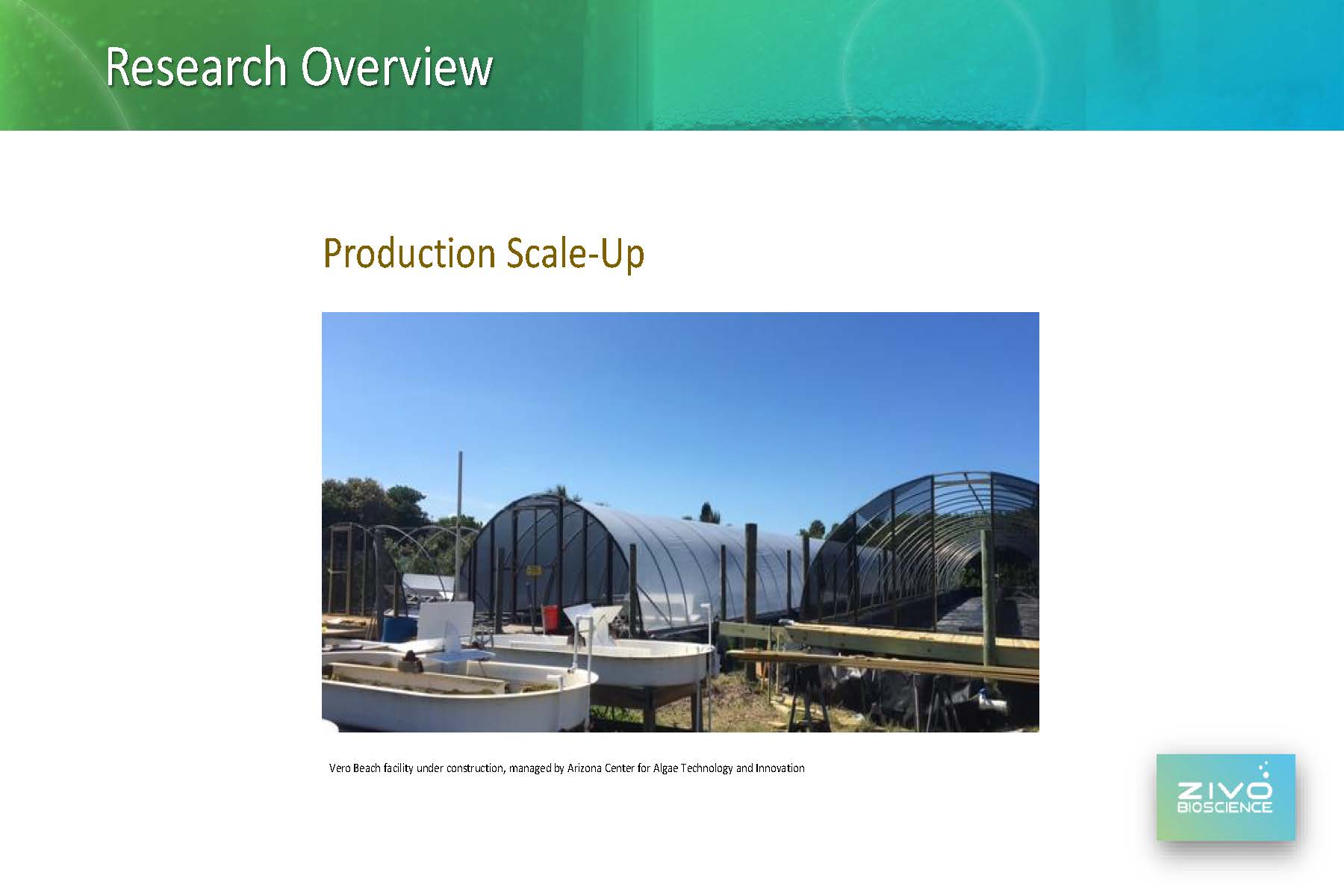

As you may know, we began to increase biomass production late last spring, when we contracted Florida Algae, based in Vero Beach Florida, to grow our algae in covered outdoor ponds. In October 2016 Hurricane Matthew essentially shut down the growing operations.

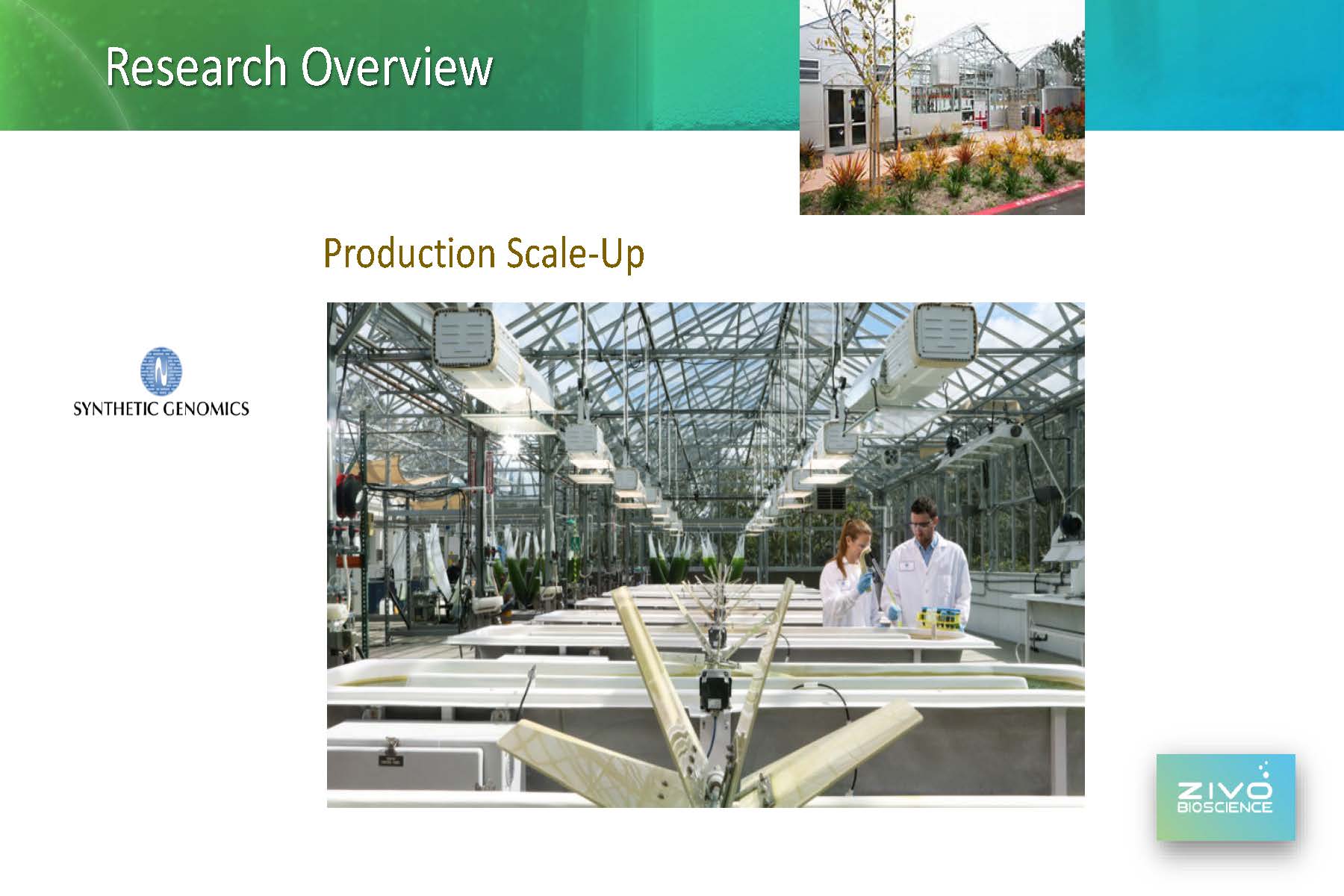

We immediately responded to this by beginning talks with Synthetic Genomics, Inc., or SGI, based in La Jolla, California and…

In early December 2016, entered into an agreement to furnish algal biomass, supernatant, optimized cultivation methods and supporting documentation so that the algae can be produced anywhere in the world under cGMP and FDA food production standards.

We were asking SGI to provide us with algae to keep the bovine mastitis research going on the therapeutic side. We were also contracting SGI to provide algae for feed and food testing, so the demands for production of high-quality feedstock increased substantially.

Dr. Louis Brown, who runs the SGI Imperial Valley facility, expended considerable effort amplifying the algae and growing it in successively larger ponds, and then managing the summer heat when daytime temperatures regularly hit 120 degrees.

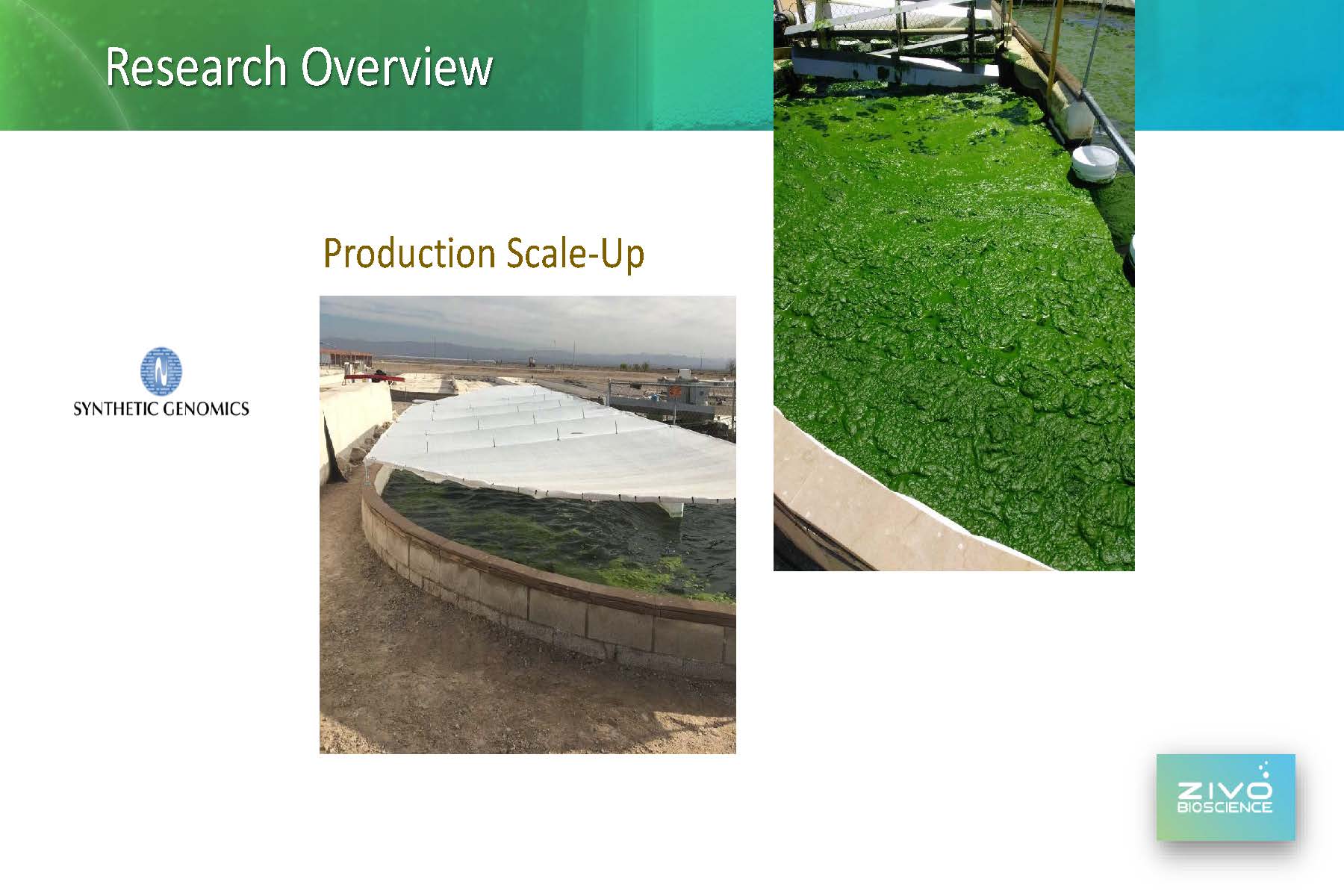

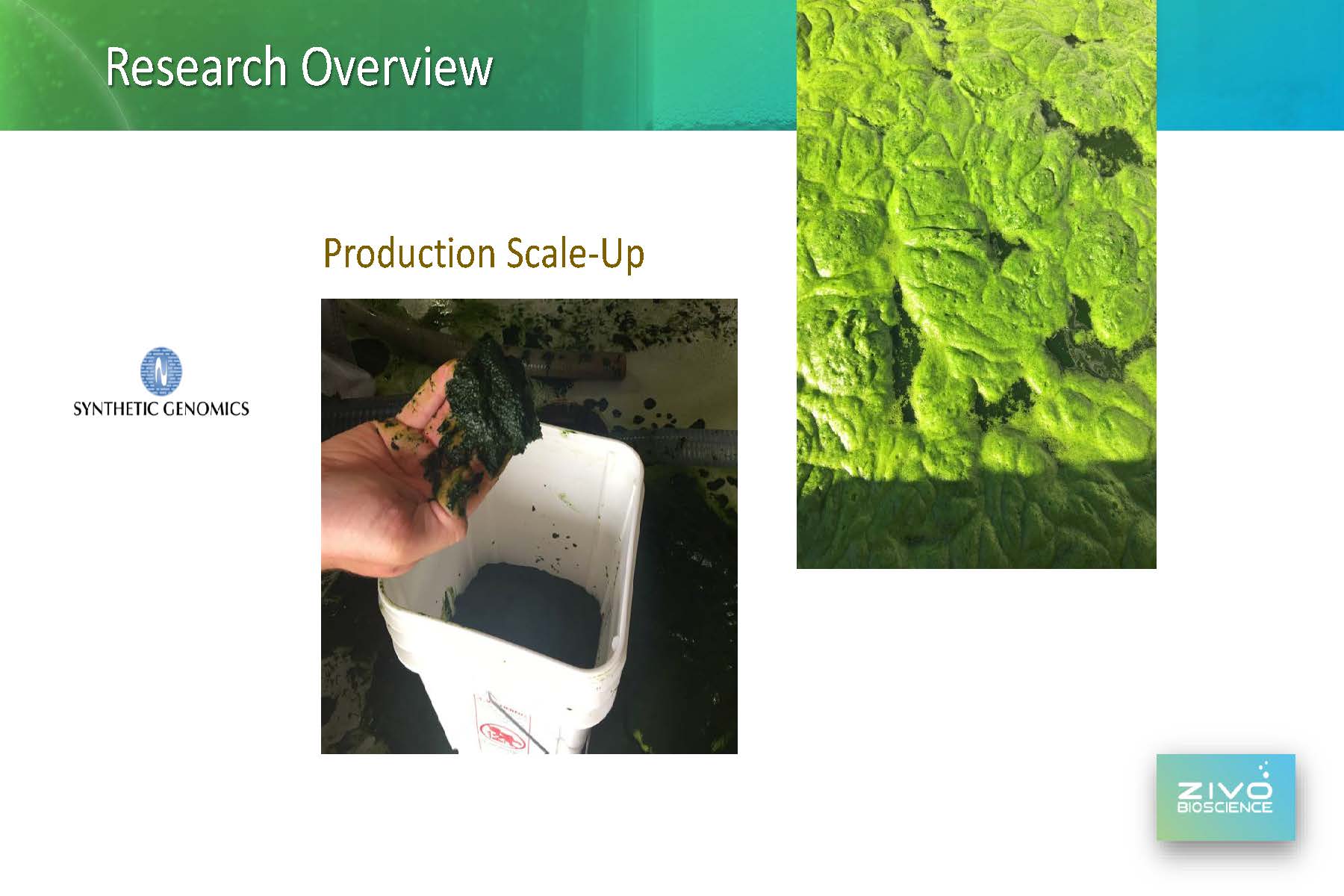

These are images of the SGI Imperial Valley facility. Our algae strain naturally flocculates, or rises to the surface in a thick mat. This has some advantages: By creating a light barrier, our algae blocks sunlight to other algae and parasites that may compete with it. Also, the floating mat makes it easier to harvest our strain – something that can be exploited commercially.

I had mentioned culture amplification. From March to today, Dr. Brown and his team scaled up the algae culture from small ½ liter flasks up to 50,000-liter ponds and then finally into this 1 million liter open pond 19 where we expect to harvest almost a ton of biomass this month, and plan to do so for the next couple of months.

Dr. Rob Brown, Vice-President of SGI’s phototrophic operations, no relation to Dr. Louis Brown, advised us to consider a non-GMO, classical strain development program to help optimize growth, heat tolerance and enhanced production.

The first step was to engage SGI genetic scientists to fully sequence the genome of our proprietary algae strain.

That gene sequencing commenced in early May, and we’re awaiting results.

In May of this year, we reached out to Algatek as a potential backup production resource to SGI. Algatek produces biomass in 65,000 liter photobioreactors at its facility in Asturias, Spain. The Algatek photobioreactors are triangular in cross section, about 2 feet by 3 feet by 3 feet, and roughly 100 yards long. The sun is replaced with high-intensity LEDs arranged across the top of the bioreactor.

Unlike outside ponds, Algatek engineers have very precise control of every environmental factor and can manipulate them to see if cultivation speed or quality is improved. We’re expecting a report shortly.

At the same time, Algatek is exploring an algal paste product for the European aquaculture market, featuring our proprietary algae.

In October, Algatek engaged the Institute of Marine Oceanology to test our algae in cultivations of shrimp, shellfish, mackerel, salmon and cod. We are awaiting results of those tests and expect to publish them in early December.

Back in the US, we entered into a licensing agreement with animal health innovator NutriQuest in April of this year. Our partners at NutriQuest wasted no time in arranging for tests of our dried algal biomass as a potential feed ingredient. To date, we have completed two poultry studies and one piglet study.

The poultry studies, specifically targeting broilers, were very successful in boosting productivity across the board by making the birds healthier and less susceptible to pathogens common on chicken farms. Next week, we begin a third poultry test to establish price-performance parameters. At the request of our licensee, we’re not disclosing the specific results or targets of these tests publicly, so that NutriQuest can maintain a competitive advantage as we move toward market launch next year.

We are, however, quite pleased with the results, and our licensee is pressing us to complete the regulatory process so that we can enter the market with a very competitive phytogenic poultry feed ingredient. For those of you unfamiliar with the poultry industry here in the US, the annual amount of poultry feed consumed in the US exceeds 61 billion pounds, according to our friends at NutriQuest.

In the global poultry feed market, phytogenic ingredients is the fastest growing segment, currently generating about $780 million in sales annually, and growing at 8% annually.

We could very well take a substantial share of that market segment as we build production capacity.

Last year, we advised our board that production capacity would be a point of constraint on our growth from the food side of the business. The pharma side is not affected by production capacity.

Rather than raise money or create debt to build and operate our own facilities, ZIVO principals had planned to outsource production to established algae growers, providing them with our algal strain and technical support in return for guaranteed production quotas.

To that end, we hired Harmon Consulting principal Valerie Harmon, formerly Director of Cultivation Practices at Cyanotech, a stint as Director of Cultivation for Aurora Algae in Australia, and then back to Hawaii as Director of R&D for Cellana, along with a business development role in each over the past 20 years. Ms. Harmon was retained in early October to identify, vet and engage established algae growers around the world, initially focusing on India, China and parts of Southeast Asia. She will be visiting the most promising prospects in the next few weeks to make sure they are capable of growing at the scale we demand, and still meet quality and safety standards. From that point forward, she will assist us in arranging the contracts and coordinating tech transfer and support to these growers.

We would, in effect, be building a global supply chain, acting as exclusive brokers and importers of our own algal biomass into the US or EU.

This requires specific expertise and we have also engaged Mr. Joe Miele, a food and beverage industry consultant and project manager with a track record of leading multifunctional and multinational teams in commercializing innovative food and beverage products, an expertise honed at Pepsico and its subsidiary Tropicana, where he led the commercialization effort of the Tropicana Pure Premium product line from lab to launch, as well as other Pepsico co-ventures with Starbucks and Lipton Tea.

We mentioned the Burdock Group in last year’s shareholder meeting. Burdock is managing the FDA compliance process for ZIVO, as they have for dozens of companies over the past 20-plus years. At this juncture, we are expecting to conclude our FDA-mandated product stability study by year’s end, or a bit into January, as well as the long-term toxicology study required for human GRAS self-certification. The dried algal biomass is doing well in both studies. As soon as the human GRAS certification effort is completed, we will immediately pursue certification in poultry, dovetailing that approval with the expected availability of our poultry feed product in early to mid-2018.

On the food/feed side of the business, as we near the conclusion of the human FDA regulatory process with our algal biomass, ZIVO is transitioning from research and compliance to the operational aspects of production and marketing. That includes building a small, agile team to handle a virtualized food and beverage ingredient supplier and licensor of intellectual property. We are relying on our key consultants, including Ms. Harmon and Mr. Miele to bring subject matter expertise to the table.

We have, however, concluded that an operating executive is now critically necessary, and so have retained Mr. Adam Chiasson to fill the role of Vice-President, Operations. Adam most recently served as Director of Operations at Accuri Cytometers, a rising star of Michigan’s biomed startups, recently purchased by BD Life Sciences, also known as Becton Dickinson. Rather than moving with the Accuri acquisition to San Diego, Mr. Chiasson chose to stay in Michigan, much to our advantage. He possesses the skills and expertise required to build and operate a global supply chain and a lean organization to move the company forward.

On the pharma side, in order to have a valuable “discovery stage” therapeutic candidate, ZIVO Bioscience, must fully describe the bioactive compound or compounds, an activity we refer to as Analysis or Characterization, and then prove that it works as intended, which we refer to as Validation. Most of the results that we publish are the validation studies – does it work for a specific disease in a specific animal model, and is it safe on a variety of levels.

Test results for bovine mastitis, canine joint health and human cholesterol are all considered therapeutic targets, meaning the resulting product will be classified as a drug, not as a dietary supplement or a food/feed ingredient. This is an important distinction because it’s easy to confuse therapeutic targets with nutritional health claims for the algae itself. Both may, in the end, be very valuable.

In terms of our pharma program, we have a great disease model, great validation results and high confidence that we could repeat them again. This year, we’ve been accelerating the analysis work so that it can dovetail with the validation work, the combined results forming the basis for a discovery-stage pharma deal with our development partner.

To help manage this work, we’ve engaged immunologist Dr. Paul Wooley, a pioneer in glycocalyx research and immune models as a senior consultant. Dr. Wooley is a former professor of Biology at Wichita State, professor of Orthopedic Surgery at University of Kansas School of Medicine and Wayne State University School of Medicine, and among other posts, is Chief Science Officer at Kardiatonos Inc.

Dr. Wooley works closely with Dr. Amy Steffek, our director of R&D, to shape the direction of research underway. We have engaged a number of contract research organizations and university labs to works in multiple parallel pathways, sharing information to compress timeframes.

We’ve contracted with the University of Georgia’s Center for Complex Carbohydrate Research, The National Center for Natural Products Research at the University of Mississippi, the Donald Danforth Plant Science Center in St. Louis, Elicityl in Grenoble, France, Chemily Glycosciences in Atlanta and the Boston Institute for Biotechnology to undertake analysis of bioactive compounds.

We anticipate that the analysis work conducted with this group will dovetail with the in vivo and in vitro validation work being conducted by Dr. Alfonso Lago at Dairy Experts in California, and Dr. Raphael Nir at SBH Biosciences in Natick, Massachusetts, respectively. Together, this would form the package submitted to our drug development partner.

The information we gather in the pharma research and development effort also has an influence on the food/feed applications. We are specifically referring to the non-starch polysaccharides, or NSPs, that have long been known to provide nutritional benefits. Chinese and Japanese food science researchers have been studying these compounds for decades. Most every plant and algal specie produces NSPs, but they are as individual as fingerprints, in the sense that each of the known 72,000 algal species seems to produce its own variation of these polysaccharides, each of which has differing degrees of bioavailability, absorption, solubility, bioactivity, stability, ease of extraction and therefore, commercial value.

Last year, we introduced a vegan protein drink ingredient at the annual shareholders meeting. Some of you may have sampled it. We continue to develop the processes to deliver a stable, healthful and palatable food/feed ingredient. In the case of algae, once it’s grown, the next step is to rinse, dewater and dry that algae as quickly as possible because it degrades quickly once it’s removed from the pond, affecting the yield and quality. This is especially true in hot climates like India, Southeast Asia and the American Southwest.

Over the past year, ZIVO researchers and vendors have been testing different dewatering techniques, drying processes and pre-processing methods to create an adaptable ingredient for foods and beverages. Taste-testing aside, food and beverage manufacturers are concerned with safety, stability, solubility, mouth feel, odor and most importantly, cost. Will it stay in solution or create sediment? Will it interact with other ingredients to create off-notes or unpleasant odors? Will it bleed green pigment or pheophorbides into other ingredients? Will it require special handling that will add cost?

We’ve tested various drying processes – belt, spray-dry and drum, with different companies and operating conditions, subjecting all the samples to rigorous safety testing before they’re used in poultry or mouse studies. Working with two different food labs, we’ve developed post-drying processes to make sure that odor levels remain stable and neutral, and the same applies to taste. These procedures are part of the licensing package we provide to potential customers who may be integrating our algal biomass into their production workflow.

To summarize, ZIVO principals have been working in two separate tracks to deliver licensable intellectual property to strategic partners. There is no shortage of opportunity or demand for our products. It is more a calculation of which product and market vertical will yield the most value in the shortest period of time, given the available financial, scientific and production resources at hand. We can go in many different directions, all of them interesting and exciting, but the reality is we need to remain focused on two, maybe three, key opportunities. The others will resolve themselves as revenues are realized.

Phil Rice and I have extensively modeled the financial implications of a half-dozen market verticals of 33 such verticals in our spreadsheets, and we confirm there is no lack of opportunity, tempering with a realistic assessment of how quickly we can ramp up production to satisfy demand.

I am asked this question frequently, so we’ll address it here again: Some of our stakeholders are concerned about time gaps between studies, results and follow-up work. The Company has no internal testing facilities, no lab or clinical staff. Other than our exceptional director of R&D, supported internally by our administrative liaison and contract consultants, the R&D work is conducted by independent labs, contract research organizations, academic institutions or independent researchers.

We accommodate the schedules and workloads of these institutions and individuals, and then coordinate their schedules and deliverables with our timing parameters and capital funding realities. Sometimes, the schedule and deliverables line up perfectly. Other times, they do not. It’s a lot of work for a small staff, but it is ultimately a cost-effective and flexible approach, because it allows us to change direction without having to lay off researchers specialized in one area of science and auction off costly lab equipment or shut down facilities, and then find competent scientists in another area of research, only to then rebuild a lab for their specific requirements. Some biotechs have been forced to do so. Many did not survive the transition. The Company can remain flexible in the face of changing circumstances, especially when there are gaps in funding.

We’ve been able to recruit top researchers in specialized fields of study, make our best deal and adjust to the timeframe available. In the end, we’re not married to one research organization, one university or even a single course of action. And the same will hold true with our compliance, manufacturing and marketing partners.

Just to wrap this up, the upcoming milestones we’re looking forward to announcing over the next several months are:

Conclusion of the bovine mastitis study and negotiation for an option or licensing deal

Obtain GRAS status for human consumption of algal biomass

Obtain GRAS/AAFCO status for poultry feed ingredient

Expand global production capacity through offtake agreements

That brings you up to date on ZIVO’s core business. I’d like to turn our attention to WellMetris, the metabolic testing platform ZIVO acquired in August of 2013.

For those of you unfamiliar with this wholly owned subsidiary of ZIVO Bioscience, WellMetris LLC was created to accept the assets of Wellness Indicators, Inc. formerly headquartered in Wauconda, Illinois, after its primary lender foreclosed on the core assets in early 2013. ZIVO Bioscience has over time diverted a very small portion of its capital funding and some senior staff time to redevelop the wellness technology, secure important IP and create new IP to expand upon the original product thesis and market assumptions. We have recently secured a new name and the relevant Web domain – WellMetrix.

WellMetrix is in the business of developing a novel metabolic testing platform that offers unprecedented insights into personal health and nutrition, all in the privacy of your own home, on your own smartphone. There are several patents pending and 5 more applications in process. We are positioning WellMetrix to take advantage of several converging trends.

WellMetrix offers unprecedented insights into personal health with a rapid and novel self-administered urine test that determines if you’re really healthy or on the opposite end of the spectrum, truly unhealthy but asymptomatic. Medical diagnostics are not designed to answer these questions.

Our test measures 8 biomarkers for oxidative stress, inflammation, capacity for stress and other indicators to gauge metabolic efficiency – or, how healthy you are.

The market verticals are substantial and open to innovation at this level. However, we have moved product development forward in small increments, given the focus on monetizing ZIVO assets over the last year.

We’re now considering a way to spin off WellMetris or fund it independently of ZIVO, but still retain a significant equity stake for ZIVO and its shareholders. The Company has retained The Sandstone Group, an affiliate of Newbridge Securities, Inc., based in Miami, Florida to act as Merger & Acquisitions advisor.

We will keep our shareholders apprised of progress on this front.

Thank you for your attention. I’d like to invite our board chair and chief financial officer, Philip Rice, back to the podium. We’ll begin taking questions shortly.

Q&A

Thank You