UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.)

| ☒ | Filed by the Registrant |

|

|

|

| ☐ | Filed by a Party other than the Registrant |

|

|

|

| Check the appropriate box: | |

|

|

|

| ☐ | Preliminary Proxy Statement |

|

|

|

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

| ☒ | Definitive Proxy Statement |

|

|

|

| ☐ | Definitive Additional Materials |

|

|

|

| ☐ | Soliciting Material Under §240.14a-12 |

| Zivo Bioscience, Inc. |

| (Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

|

|

|

| ☐ | Fee paid previously with preliminary materials. |

|

|

|

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS OF

ZIVO BIOSCIENCE, INC.

To be held June 12, 2023

TO THE SHAREHOLDERS OF

Zivo Bioscience, Inc.:

We are pleased to invite you to attend our 2023 Annual Meeting of Shareholders (the “Annual Meeting”) of Zivo Bioscience, Inc. to be held on Monday, June 12, 2023, at 10:00 a.m. Eastern Time at 3600 Centerpoint Parkway, Pontiac, MI 48341.

The attached Proxy Statement describes the matters proposed by your Board of Directors to be considered and voted upon by our shareholders at our Annual Meeting. These items are more fully described in the following pages, which are hereby made part of this Notice.

The Annual Meeting will be held for the following purposes:

| 1. | To elect one Class I director to hold office until the 2026 annual meeting of shareholders; |

|

|

|

| 2. | To ratify the appointment of our independent registered public accounting firm for the fiscal year ending December 31, 2023; and |

|

|

|

| 3. | To approve (on an advisory basis) the compensation of our named executive officers. |

The Board of Directors has fixed the close of business on April 20, 2023 as the record date for determination of the shareholders entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. Only holders of common stock of record at the close of business on April 20, 2023 will be entitled to notice of, and to vote at, the Annual Meeting or at any adjournment or adjournments thereof.

We currently intend to hold the Annual Meeting in person. However, in the event we determine it is not possible or advisable to hold the Annual Meeting in person, we will publicly announce alternative arrangements for the Annual Meeting as promptly as practicable before the Annual Meeting, which may include holding the Annual Meeting solely by means of remote communication (i.e., a virtual-only Annual Meeting). Please monitor our website at www.zivobioscience.com for updated information.

Even if you are planning on attending the Annual Meeting, please promptly submit your proxy vote via the Internet, by telephone, so your shares will be represented at the Annual Meeting. Instructions on voting your shares are on the proxy materials you received for the Annual Meeting.

| 1 |

Zivo Bioscience, Inc.

21 E. Long Lake Road, Suite 100

Bloomfield Hills, MI 48304

(248) 452-9866

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 12, 2023

INFORMATION CONCERNING SOLICITATION AND VOTING

Our Board of Directors (the “Board”) solicits your proxy on our behalf for the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) and at any postponement or adjournment of the Annual Meeting for the purposes set forth in this Proxy Statement. The Annual Meeting will be held at 3600 Centerpoint Parkway, Pontiac, MI 48341 on Monday, June 12, 2023 at 10:00 a.m. local time.

On or about April 28, 2023, we intend to mail to our shareholders of record a Notice of Internet Availability of Proxy Materials (the “Notice”). The Notice will contain instructions on how to access this Proxy Statement and our 2022 annual report to stockholders, through the Internet and how to vote through the Internet. The Notice also will include instructions on how to receive such materials, at no charge, by paper delivery (along with a proxy card) or by e-mail. Beneficial owners will receive a similar notice from their broker, bank, or other nominee. Please do not mail in the Notice, as it is not intended to serve as a voting instrument. Notwithstanding anything to the contrary, we may send certain stockholders of record a full set of proxy materials by paper delivery instead of the notice or in addition to sending the notice.

We currently intend to hold the Annual Meeting in person. However, in the event we determine it is not possible or advisable to hold the Annual Meeting in person, we will publicly announce alternative arrangements for the Annual Meeting as promptly as practicable before the Annual Meeting. Please monitor our website at www.zivobioscience.com for updated information.

Unless we state otherwise or the context otherwise requires, references in this proxy statement to “we,” “our,” “us”, or the “Company” are to Zivo Bioscience, Inc., a Nevada corporation.

Voting of Shares by Proxy

Shareholders may vote at the Annual Meeting by attending in person or by proxy. Execution of a proxy will not in any way affect a shareholder’s right to attend and vote at the Annual Meeting. Any proxy given pursuant to this solicitation may be revoked by the person giving it any time before it is voted. Proxies may be revoked by (1) filing with our Secretary, before the taking of the vote at the Annual Meeting, a written notice of revocation bearing a date later than the date of such proxy, (2) duly executing a later dated proxy relating to the same shares and delivering it to our Secretary before the taking of the vote at the Annual Meeting or (3) attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy). If your shares are held in “street name,” that is, you hold your shares in an account with a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from your broker or other holder of record, to be able to vote at the Annual Meeting. Any written notice of revocation or subsequent proxy should be sent to Zivo Bioscience, Inc., 21 E. Long Lake Road, Suite 100, Bloomfield Hills, MI 48304, attention: Corporate Secretary, at or before the taking of the vote at the Annual Meeting.

Record Date

The close of business on April 20, 2023 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. As of April 20, 2023, we had outstanding 9,419,660 of our common stock, par value $0.001 (the “Common Stock”). A shareholder is entitled to cast one vote for each share held on the record date on all matters to be considered at the Annual Meeting.

| 2 |

Quorum and Votes Required

The representation in person or by proxy of at least a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to establish a quorum for the transaction of business at the Annual Meeting. Votes withheld from a nominee, abstentions and broker “non-votes” are counted as present or represented for purposes of determining the presence or absence of a quorum. A “non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a proposal because the broker does not have discretionary voting power and has not received instructions from the beneficial owner.

Directors will be elected by a plurality of the votes cast by shareholders entitled to vote at the Annual Meeting. Proposals 2 and 3 require the affirmative vote of the majority of the votes cast at the Annual Meeting. An automated system administered by our transfer agent tabulates the votes. The vote on each matter submitted to shareholders is tabulated separately. Abstentions and broker “non-votes” are included in the number of shares present or represented for purposes of determining whether there is a quorum, but are not considered as shares voting or as votes cast with respect to any matter presented at the Annual Meeting. As a result, abstentions and broker “non-votes” will not have any effect on any of the proposals.

The persons named as the proxies, John B. Payne and Keith R. Marchiando, were selected by the Board and are executive officers of the Company.

By order of the Board of Directors

Zivo Bioscience, Inc.

/s/ Keith R. Marchiando

Keith R. Marchiando

Chief Financial Officer

April 28, 2023

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING

The Notice of 2023 Annual Meeting of Stockholders, the accompanying Proxy Statement, and the 2022 annual report are available at https://www.iproxydirect.com/index.php/ZIVO.

| 3 |

| 4 |

| Table of Contents |

QUESTIONS AND ANSWERS

| Q: | What may I vote on? |

|

|

|

| A. | You may vote on the following proposals: |

|

|

|

| 1. | ELECTION OF DIRECTORS |

There is one nominee for election to the Company’s Board this year: one Class I director named in the Proxy Statement to hold office until the 2026 annual meeting.

Your Board recommends a vote FOR the nominee.

| 2. | RATIFICATION OF AUDITOR |

We are requesting that shareholders approve the ratification of the appointment of our independent registered public accounting firm for the fiscal year ending December 31, 2023.

Your Board recommends a vote FOR the ratification of the appointment of our independent registered public accounting firm for the fiscal year ending December 31, 2023.

| 3. | ADVISORY VOTE ON EXECUTIVE COMPENSATION |

We are requesting that shareholders approve, on an advisory basis, the compensation of our named executive officers.

Your Board recommends a vote FOR the approval of the compensation of our named executive officers.

| Q: | Who is entitled to vote? |

|

|

|

| A: | Shareholders of record as of the close of business April 20, 2023 are entitled to vote at the Annual Meeting. |

|

|

|

| Q: | How do I vote? |

| A: | Stockholders of Record. You may vote by internet, by phone or by completing, signing and returning the enclosed proxy card in the postage-paid envelope provided. To vote by internet or phone, you will need to use a control number provided to you in the materials with this proxy statement and follow the additional steps when prompted. The steps have been designed to authenticate your identity, allow you to give voting instructions, and confirm that those instructions have been recorded properly. |

|

|

|

|

| Beneficial Owners. If you are a beneficial owner, you must vote your shares in the manner prescribed by your broker, bank or other nominee. You will receive a voting instruction card (not a proxy card) to use in directing the broker, bank or other nominee how to vote your shares. You may also have the option to vote your shares via the internet or phone. |

| Q: | How does discretionary authority apply? |

|

|

|

| A: | If you sign your proxy card or voting instruction card, but do not make any selections, you give authority to John B. Payne, Chief Executive Officer, and Keith R. Marchiando, Chief Financial Officer, to vote in their discretion on each proposal and any other matter that may properly come before the Annual Meeting. |

| 5 |

| Table of Contents |

| Q: | How many shares can vote? |

|

|

|

| A: | As of the close of business on the record date, April 20, 2023, there were 9,419,660 shares of Common Stock issued and outstanding. Every holder of Common Stock as of the close of business on April 20, 2023, the record date, is entitled to one vote for each share held. |

| Q: | What is a “quorum?” |

|

|

|

| A: | The presence of the holders of a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting, whether in person or by proxy, constitutes a “quorum” at the Annual Meeting. There must be a quorum for the Annual Meeting to be held. |

| Q: | Who can attend the Annual Meeting? |

|

|

|

| A: | All shareholders that held shares of our Common Stock on April 20, 2023, the record date, are entitled to attend. |

|

|

|

| Q: | Can a shareholder nominate someone to be a director of ZIVO? |

| A: | Our bylaws do provide a procedure for shareholders to nominate directors. Nominations for the election of directors may be made by the Board or by any shareholder entitled to vote for the election of directors. Subject to compliance with applicable United States securities laws and the rules and regulations of the Securities and Exchange Commission (“SEC”), nominations by shareholders may be made by notice in writing to the Secretary of the Company not less than 14 days nor more than 60 days prior to any meeting of the shareholders called for the election of directors; provided, however, that if less than 21 written days’ notice of the meeting is given to shareholders, such notice of nomination by a shareholder shall be given to the Secretary of the Company not later than the close of the fifth day following the day on which notice of the meeting was mailed to shareholders. |

The Board has a standing Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee, in selecting individuals to be nominated for election to the Board, considers, among other things, the following qualifications in nominating an individual: diversity in background, age, experience, qualifications, attributes and skills, independence, integrity, business experience and acumen, education, accounting and financial expertise, reputation, civic and community relationships and industry knowledge and relationships. In nominating an existing director for re-election to the Board, the Board will consider and review an existing director’s attendance, performance and length of service.

| Q: | Who is soliciting proxies? |

|

|

|

| A: | Your proxy is being solicited by the Board of ZIVO on behalf of ZIVO. The cost of the solicitation shall be borne by the Company. It is anticipated that solicitations of proxies for the meeting will be made only by use of the mail; however, we may use the services of our directors, officers and employees to solicit proxies personally or by telephone, without additional salary or compensation to them. Brokerage houses, custodians, nominees and fiduciaries will be requested to forward the proxy soliciting materials to the beneficial owners of our shares held of record by such persons, and we will reimburse such persons for their reasonable out-of-pocket expenses incurred in the performance of that task. |

| Q: | How can I access the Company’s proxy materials and annual report on Form 10-K? |

|

|

|

| A. | A: The “Investors” section of the Company’s website, http://www.zivobioscience.com, provides access, free of charge, to SEC reports as soon as reasonably practicable after the Company electronically files such reports with, or furnishes such reports to, the SEC, including proxy materials, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports. In addition, a copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 will be sent to any shareholder, without charge, upon written request sent to the Company, addressed to Keith R. Marchiando, Chief Financial Officer, Zivo Bioscience, Inc., 21 E. Long Lake Road, Suite 100, Bloomfield Hills, MI 48304. Alternatively, the Company’s Annual Report on Form 10-K and the proxy statement may be accessed at: https://www.iproxydirect.com/index.php/zivo. |

The references to the website addresses of the Company in this proxy statement are not intended to function as a hyperlink and, except as specified herein, the information contained on such websites is not part of this proxy statement.

| 6 |

| Table of Contents |

Our Board is divided into three classes. Members of each class serve staggered terms. Our Class I director will stand for election at this meeting. The terms of office of directors in Class II and III do not expire until the annual meetings of shareholders to be held in 2024 and 2025, respectively, each holding office until their respective successors have been duly elected and qualified, or until he or she becomes disabled or is otherwise removed.

Director Nominee

Our Board has nominated Christopher D. Maggiore, age 57, for election as a Class I director to serve for a three-year term ending at the 2026 annual meeting, or until his successor is duly elected and qualified, or until he becomes disabled or is otherwise removed. Mr. Maggiore is a current member of our Board and has consented to serve if elected.

Mr. Maggiore will be elected by a plurality of the votes present in person or represented by proxy at the Annual Meeting and entitled to vote. This means that the individual nominated for election to the Board at the Annual Meeting receiving the highest number of “FOR” votes will be elected. You may either vote “FOR” the nominee or “WITHHOLD” your vote with respect to the nominee. Shares represented by proxies will be voted “FOR” the election of the Class I nominee, unless the proxy is marked to withhold authority to so vote. Proxies may not be voted for a greater number of persons to the Board than the number of nominees named herein. If the nominee is unable or unwilling to serve at the time of the Annual Meeting, which we do not expect to happen, the persons named as proxies may vote for a substitute nominee chosen by the present Board, or the Board will have a vacancy, which it may fill at a later date or reduce the size of the Board. We have no reason to believe that the nominee will be unwilling or unable to serve if elected as a director. Additional information regarding the director nominee and directors of the Company is set forth below.

Christopher D. Maggiore

Mr. Maggiore was appointed in August 2013 to serve as a director of the Company. He serves on the Audit Committee and Compensation Committee. Mr. Maggiore is a successful private investor and has been involved in real estate development, building and management of businesses for over 25 years. He currently owns and manages a portfolio of businesses and investments. Mr. Maggiore provides the Board with experiences as a successful entrepreneur and builder of business organizations.

| 7 |

| Table of Contents |

Continuing Directors

The following table provides information regarding the directors who are serving for terms that end following the Annual Meeting as of April 28, 2023:

| NAME |

| AGE |

| TITLE |

| CLASS |

| Nola E. Masterson |

| 76 |

| Director |

| Class II |

| John B. Payne |

| 75 |

| Director and Chief Executive Officer |

| Class III |

| Alison A. Cornell |

| 61 |

| Director |

| Class III |

Nola E. Masterson

Ms. Masterson was appointed in September 2014 to serve as a director of the Company. Since 1982, she has been the chief executive officer of Science Futures, Inc., an investment and advisory firm. Ms. Masterson is currently managing member and general partner of Science Futures LLC, I and II, which are venture capital funds invested in life science funds and companies. Ms. Masterson was a Venture Partner in TVM Capital, a large Global venture firm. She was a member of the board of directors of Repros Therapeutics Inc. (sold to Allergan plc (NYSE: AGN) in January 2018) and served on the audit committee, nominating committee, and the compensation committee at that company. She was an Adjunct Professor in the Management School of the University of San Francisco. Ms. Masterson was a biotechnology analyst on Wall Street, working with Drexel Burnham Lambert and Merrill Lynch, and is a co-founder and CEO of Sequenom, Inc., a genetic analysis company located in San Diego, California which has been sold to LabCorp. Ms. Masterson is the Chair Emeritus of the California Life Science Association Institute, a 501(c)(3) organization, which promotes science education, workforce development and best practices as well as entrepreneurs in the bioeconomy. Ms. Masterson began her business career at Ames Company, a division of Bayer, and spent eight years at Millipore Corporation in sales and sales management and as Vice President of the Biotechnology Division. She received her master’s degree in Biological Sciences from George Washington University, and continued Ph.D. work at the University of Florida. Ms. Masterson provides us with the benefit of her extensive experience as an entrepreneur and an analyst on Wall Street, as well as her 40 years of investment advisory expertise and experiences in the life sciences industry.

John B. Payne

Mr. Payne was appointed to serve as President and Chief Executive Officer of the Company in January 2022, and as a director of the Company in July 2013. Mr. Payne is the Vice Chairman of the Board of National Veterinary Associates, and formerly President and CEO of Compassion-First Pet Hospitals (from 2014-2020), which he founded in 2014. Compassion-First Pet Hospitals is a family of specialty and emergency veterinary hospitals throughout the United States and is dedicated to changing the veterinary landscape and elevating patient outcomes. With 100+ hospitals across 22 states, Compassion-First has more than 3,000 employees and more than 230 board-certified veterinary specialists across a wide range of medical disciplines. Mr. Payne currently serves as the Chairman of the Board for American Humane and is Chairman of the Board for ZIVO Bioscience. He is the Vice Chairman of the Board of Regents at Ross University School of Medicine and School of Veterinary Medicine. He also served on the board of directors of Nexvet, a bio science company located in Dublin, Ireland until the company was sold to Zoetis in 2018. Prior to creating Compassion-First, Mr. Payne served as a member of the Global Leadership Team for Mars Pet Care. He also served as the President and CEO of Banfield Pet Hospitals and served as the President and General Manager of Bayer Healthcare’s North American Animal Health Division. Mr. Payne provides the Board with valuable insight and experience in the animal care and pharmaceutical fields.

Alison A. Cornell

Ms. Cornell was appointed in February 2021 to serve as a director of the Company. She serves on the Audit Committee as Chair, the Compensation Committee as Chair, and on the Nominating and Corporate Governance Committee. Ms. Cornell served as the Executive Vice President & Chief Financial Officer of Compassion-First Pet Hospitals from July 2017 through 2021. Previously, she served as Executive Vice President & Chief Financial Officer of International Flavors & Fragrances Inc. (NYSE: IFF, Euronext Paris: IFF) from July 2015 through October 2016, and before that, she served multiple roles at Covance, Inc. (NYSE: CVD) from 2004 through July 2015, including Corporate Senior Vice President & Chief Financial Officer. Ms. Cornell provides the Board with extensive business and financial experience.

| 8 |

| Table of Contents |

Votes Required to Elect Directors; Board Recommendation

Directors are elected by a plurality of the votes of the shares entitled to vote in the election and present, in person or by proxy, at the Annual Meeting.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF CHRISTOPHER D. MAGGIORE AS A DIRECTOR OF THE COMPANY.

INFORMATION WITH RESPECT TO THE BOARD OF DIRECTORS

The following is a brief description of the structure and certain functions of our Board. Each of the current directors is serving until his or her respective successor is duly elected and qualified, subject to earlier resignation. The Board currently consists of four directors, one of whom is an employee director, and one of whom has been nominated for election as a director at this Annual Meeting. During 2022, our Board determined that Mr. Maggiore, Ms. Cornell, Ms. Masterson were all independent within the meaning of the listing standards of the Nasdaq Stock Market LLC (“Nasdaq”). Mr. Payne was considered independent until his appointment as Chief Executive Officer on January 7, 2022. Under the rules of Nasdaq, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Each director was nominated based on his or her knowledge of the Company, his or her skills, expertise and willingness to serve as a director. The Board usually meets in scheduled meetings either in person, via conference telephone call or other remote means. The Board held 6 meetings during the fiscal year ended December 31, 2022. Each of the directors attended at least 75% of the scheduled meetings of the Board, and applicable committee meetings, if such director served on the committee, during the period. Members of the Board are strongly encouraged to attend the Company’s annual meeting of shareholders in person. If attendance in person is not possible, members of the Board are strongly encouraged to attend the Company’s annual meeting of shareholders via telephone or similar communication equipment. Each of the directors attended the annual meeting of shareholders in 2022.

Structure and Operation of the Board

Mr. Payne acts as the Chairman of our Board and Chief Executive Officer. The Board has standing Audit, Compensation and Nominating and Corporate Governance committees. The following is a brief description of each of these committees.

Compensation Committee

The Compensation Committee, which is currently comprised of Ms. Cornell, as Chair, Ms. Masterson and Mr. Maggiore, may approve, depending on the availability of the full Board, grants of awards to employees, may determine the terms and conditions provided for in each option grant, and may, as requested by our President and Chief Executive Officer, review and recommend to the Board the amount of compensation to be paid to our officers. The Compensation Committee generally convenes on an as needed basis. The Compensation Committee met 2 times during 2022. The Board has determined that each member of the Compensation Committee is independent, as independence is defined under the rules of Nasdaq. Our Compensation Committee charter is available on our website, www.zivobioscience.com, under the “Investors - Corporate Governance” tab.

| 9 |

| Table of Contents |

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is currently comprised of Ms. Masterson, as Chair, and Ms. Cornell. The Nominating and Corporate Governance Committee is responsible for, among other things, considering potential members of the Board, making recommendations to the full Board as to nominees for election to the Board and assessing the effectiveness of the Board. The Nominating and Corporate Governance Committee will consider director candidates recommended by shareholders. Any such candidates will be evaluated on the same basis as other candidates being evaluated by the Nominating and Corporate Governance Committee. Information with respect to such candidates should be sent to Zivo Bioscience, Inc., 21 East Long Lake Road, Ste 100, Bloomfield Hills, MI 48304, Attention: Secretary. The Nominating and Corporate Governance Committee considers the needs for the Board as a whole when identifying and evaluating nominees and, among other things, considers diversity in background, age, experience, qualifications, attributes and skills in identifying nominees, although it does not have a formal policy regarding the consideration of diversity. The current director nominee was recommended by the Nominating and Corporate Governance Committee. The Nominating & Corporate Governance Committee did not meet in 2022. The Board has determined that each member of the Nominating and Corporate Governance Committee is independent, as independence is defined under the rules of Nasdaq. Our Nominating and Corporate Governance Committee charter is available on our website, www.zivobioscience.com, under the “Investors - Corporate Governance” tab.

Audit Committee

The Audit Committee reviews with management and the Company’s independent public accountants the Company’s financial statements, the accounting principles applied in their preparation, the scope of the audit, any comments made by the independent accountants upon the financial condition of the Company and its accounting controls and procedures and such other matters as the Audit Committee deems appropriate.

The functions of the Audit Committee include:

| · | Selecting our independent auditors; |

|

|

|

| · | Reviewing the results and scope of the audit and other services provided by our independent auditors; and |

|

|

|

| · | Reviewing and evaluating our audit and control functions. |

The Audit Committee is currently comprised of Ms. Cornell, as Chair, and Ms. Masterson and Mr. Maggiore. The Board has determined that each of Ms. Cornell, Ms. Masterson, and Mr. Maggiore is “independent’ under Nasdaq independence standards. Additionally, the Board has determined that Ms. Cornell qualifies as an “audit committee financial expert” as that term is defined in rules promulgated by the SEC. The designation of an “audit committee financial expert” does not impose upon such persons any duties, obligations or liabilities that are greater than those generally imposed on each of them as a member of the Audit Committee and the Board, and such designation does not affect the duties, obligations or liabilities of any other member of the Audit Committee or the Board.

The Audit Committee met 5 times in 2022. Our Audit Committee charter is available on our website, www.zivobioscience.com, under the “Investors - Corporate Governance” tab.

Audit Committee Report

The information contained in the following report is not considered to be “soliciting material,” “filed” or incorporated by reference in any past or future filing by us under the Securities Exchange Act of 1934, as amended (“Exchange Act”) or the Securities Act of 1933, as amended (“Securities Act”) unless and only to the extent that we specifically incorporate it by reference.

The Audit Committee has reviewed and discussed with our management and BDO USA, LLP (“BDO”) our audited consolidated financial statements as of and for the fiscal year ended December 31, 2022. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC.

The Audit Committee has received and reviewed the written disclosures and the letter from BDO required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with BDO its independence.

| 10 |

| Table of Contents |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in our company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, for filing with the SEC.

Audit Committee:

Alison A. Cornell

Christopher D. Maggiore

Nola E. Masterson

Risk Oversight

The Board oversees the Company’s risk management primarily through the following:

| · | review and approval of an annual business plan; |

|

|

|

| · | review of a summary of risks and opportunities at meetings of the Board; |

|

|

|

| · | review of business developments, business plan implementation and financial results; |

|

|

|

| · | oversight of internal controls over financial reporting; and |

|

|

|

| · | review of employee compensation and its relationship to our business plans. |

Communication with Shareholders

We have established a process for shareholders to communicate with the Board. Shareholders wishing to communicate with the Board of ZIVO can send an email to investors@zivobioscience.com or write or telephone Keith R. Marchiando at the Company’s corporate offices:

Keith R. Marchiando

Zivo Bioscience, Inc.

21 E. Long Lake Road, Suite 100

Bloomfield Hills, MI 48304

Telephone: (248) 452-9866

All such communication must state the type and amount of Company securities held by the shareholder and must clearly state that the communication is intended to be shared with the Board. Mr. Marchiando will forward all such communications to the members of the Board.

Code of Ethics

We have adopted a code of ethics that applies to the Principal Executive Officer and Principal Financial Officer, or those performing similar functions. A copy of the code of ethics is available on our website, www.zivobioscience.com, under the “Investors - Corporate Governance” tab and will be sent to any shareholder, without charge, upon written request sent to 21 East Long Lake Road, Ste 100, Bloomfield Hills, MI 48304, Attention: Secretary. Any amendments to the code of ethics will be posted on our website.

Hedging Policy

The Company, pursuant to the terms of its Insider Trading Policy, prohibits all directors, officers, employees, and certain contractors from engaging in hedging transactions including prepaid variable forwards, equity swaps, collars and exchange funds with respect to the Company’s securities.

| 11 |

| Table of Contents |

Board Diversity Matrix (as of April 28, 2023)

The following matrix is provided in accordance with applicable Nasdaq listing requirements and includes all directors as of April 28, 2023.

|

|

| Female |

|

| Male |

|

| Non-Binary |

|

| Did Not Disclose Gender |

| ||||

| Part I: Gender Identity |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Directors |

|

| 2 |

|

|

| 2 |

|

|

| - |

|

|

| - |

|

| Part II: Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| African American or Black |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Alaskan Native or American Indian |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Asian |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Hispanic or Latinx |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Native Hawaiian or Pacific Islander |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| White |

|

| 2 |

|

|

| 2 |

|

|

| - |

|

|

| - |

|

| Two or More Races or Ethnicities |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| LGBTQ+ |

|

|

|

|

|

|

|

|

|

| - |

|

| |||

| Did Not Disclose Demographic Background |

|

|

|

|

|

|

|

|

|

| - |

|

| |||

Board Diversity Matrix (as of July 5, 2022)

The following matrix is provided in accordance with applicable Nasdaq listing requirements and includes all directors as of July 5, 2022.

|

|

| Female |

|

| Male |

|

| Non-Binary |

|

| Did Not Disclose Gender |

| ||||

| Part I: Gender Identity |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Directors |

|

| 2 |

|

|

| 2 |

|

|

| - |

|

|

| - |

|

| Part II: Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| African American or Black |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Alaskan Native or American Indian |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Asian |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Hispanic or Latinx |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Native Hawaiian or Pacific Islander |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| White |

|

| 2 |

|

|

| 2 |

|

|

| - |

|

|

| - |

|

| Two or More Races or Ethnicities |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| LGBTQ+ |

|

|

|

|

|

|

|

|

|

| - |

|

| |||

| Did Not Disclose Demographic Background |

|

|

|

|

|

|

|

|

|

| - |

|

| |||

| 12 |

| Table of Contents |

Directors and Executive Officers

The following table sets forth the name, age and position of each of our executive officers and directors as of April 28, 2023:

| Name |

| Age |

| Positions |

| Since |

| John B. Payne |

| 75 |

| President and Chief Executive Officer / Director |

| 2013/2023 |

| Keith R. Marchiando |

| 61 |

| Chief Financial Officer |

| 2021 |

| Christopher D. Maggiore |

| 57 |

| Director |

| 2013 |

| Nola E. Masterson |

| 76 |

| Director |

| 2014 |

| Alison A. Cornell |

| 61 |

| Director |

| 2021 |

Information with respect to Mr. Maggiore, is contained herein under the caption “Proposal No. 1 – Election of Directors – Nominee.” Information regarding Ms. Masterson, Mr. Payne, and Ms. Cornell is contained herein under the caption “Proposal No. 1 - Election of Directors – Continuing Directors.”

Keith R. Marchiando

Chief Financial Officer

Mr. Marchiando was appointed Chief Financial Officer in January 2021. He joined the Company from New US Nonwovens, LLC (“Nonwovens”), a contract manufacturer of personal care and home care products, where he was Chief Financial Officer since August 2019. At Nonwovens, he was responsible for all aspects of the company’s financial activities, including strengthening corporate controls, implementing financial planning and developing the Company’s IT strategy. Prior to Nonwovens, he served as a consultant to Plante & Moran PLLC from January 2017 to August 2019, where he engaged in interim chief financial officer roles which included restructuring and transitioning companies in ownership changes, supporting M&A activities and enhancing financial functions and processes. Prior to this position, he served as CFO of Perceptron, Inc. beginning in February 2014, and then CFO of AP Exhaust LLC beginning in May 2015. Mr. Marchiando earned a Master’s Degree in Business Administration (MBA) in corporate finance from Carnegie Mellon University’s Tepper School of Management and an undergraduate degree in finance and economics at Lehigh University.

Each of the officers will serve as such until his or her respective successor is appointed and qualified, or until his or her earlier resignation or removal. Our Board is divided into three classes. Members of each class serve staggered terms. Our Class I director will stand for election at this meeting. The terms of office of directors in Class II and III do not expire until the annual meetings of shareholders to be held in 2024 and 2025, respectively, each holding office until their respective successors have been duly elected and qualified, or until he or she becomes disabled or is otherwise removed.

Family Relationships

There are no familial relationships between any of our officers and directors.

Procedures for Shareholders to Nominate Directors

Our bylaws provide a procedure for shareholders to nominate directors. Nominations for the election of directors may be made by the Board or by any shareholder entitled to vote for the election of directors. Subject to compliance with applicable United States securities laws and the rules and regulations of the SEC, nominations by shareholders may be made by notice in writing to the Secretary of the Company not less than 14 days nor more than 60 days prior to any meeting of the shareholders called for the election of directors; provided, however, that if less than 21 written days’ notice of the meeting is given to shareholders, such notice of nomination by a shareholder shall be given to the Secretary of the Company not later than the close of the fifth day following the day on which notice of the meeting was mailed to shareholders.

| 13 |

| Table of Contents |

Delinquent Section 16(a) Reports

Section 16 of the Exchange Act requires our directors, executive officers and any persons who own more than 10% of our common stock (“insiders”) to file initial reports of ownership and reports of changes in ownership with the SEC. Based solely on our review of the copies of such forms filed with the SEC and written representations from our directors and executive officers, we believe that during fiscal 2021 each of our insiders timely complied with applicable reporting requirements for transactions in our equity securities, except for the following: Mr. Payne filed a late Form 4 to report one transaction, and Mr. Maggiore filed three late Form 4s, one to report one transaction, one to report two transactions, and one to report three transactions.

| 14 |

| Table of Contents |

Summary Compensation Table for Fiscal Years 2022 and 2021

The following table summarizes the compensation paid to our named executive officers during or with respect to fiscal 2022 and 2021 for services rendered to us in all capacities.

| Name and Principal Position |

| Year |

| Salary ($) |

|

| Bonus ($) |

|

| Option Awards ($) (1) |

|

| Non-Equity Incentive Plan Compensation ($) |

|

| Total ($) |

| |||||

| John B. Payne |

| 2022 |

|

| 397,754 |

|

|

| - |

|

|

| 449,999 |

|

|

| 175,000 |

|

|

| 1,022,753 |

|

| Chief Executive Officer and Director(2) |

| 2021 |

|

| 12,055 |

|

|

| - |

|

|

| 677,252 |

|

|

| - |

|

|

| 689,307 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Keith Marchiando |

| 2022 |

|

| 312,000 |

|

|

| - |

|

|

| 211,768 |

|

|

| 50,505 |

|

|

| 574,273 |

|

| Chief Financial Officer(3) |

| 2021 |

|

| 291,667 |

|

|

| 72,916 |

|

|

| 2,795,959 |

|

|

| 50,000 |

|

|

| 3,210,542 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Andrew A. Dahl |

| 2022 |

|

| 4,368 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 4,368 |

|

| Former Chief Executive Officer and Director(4) |

| 2021 |

|

| 454,000 |

|

|

| - |

|

|

| 1,301,598 |

|

|

| - |

|

|

| 1,882,636 |

|

| (1) | The amounts reported reflect the grant date fair value (excluding the effect of estimated forfeitures). The grant date fair value of each warrant is calculated using the Black Scholes option-pricing model computed in accordance with FASB ASC Topic 718 and does not correspond to the actual amount that will be realized upon exercise by the named executive officers. For valuation assumptions used in determining the grant date fair value of stock options using the Black Scholes pricing model, see Note 4 to our audited financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 14, 2023. |

|

|

|

| (2) | Prior to his appointment as Chief Executive Officer, Mr. Payne was a non-employee director. The amounts included in 2021 reflect an equity grant and cash compensation Mr. Payne received while serving as a non-employee director. Since he was appointed as Chief Executive Officer, Mr. Payne has received an annual base salary as more fully described in the narrative below. |

|

|

|

| (3) | Includes payments made to Mr. Marchiando pursuant to a consulting arrangement, prior to his appointment as Chief Financial Officer of the Company. |

|

|

|

| (4) | Mr. Dahl’s employment with the Company ended on January 4, 2022. |

Executive Compensation Programs

In 2022, the Compensation Committee reviewed financial information and other performance metrics relative to the historical compensation of executive management and comparative information prepared internally. The Compensation Committee also reviewed management’s recommendations for compensation levels of all of the Company’s senior executive officers and considered these recommendations with reference to relative compensation levels of like-size institutions. The totality of the information reviewed by the Compensation Committee was considered when establishing current executive salary levels, and similar analysis is expected to be considered when reviewing and establishing future salaries and long term incentives. The Company’s compensation policies and practices are designed to ensure that they do not foster risk taking above the level of risk associated with the Company’s business model. For this purpose, the Compensation Committee generally considers the Company’s financial performance, comparing that performance to the performance metrics included in the Company’s strategic plan. The Compensation Committee also generally evaluates management’s compensation in light of other specific risk parameters. Based on this assessment, the Compensation Committee believes that the Company has a balanced pay and performance program that does not promote excessive risk taking.

| 15 |

| Table of Contents |

The Company’s compensation programs are aimed at enabling it to attract and retain the best possible executive talent and rewarding those executives commensurate with their ability and performance. The Company’s compensation programs consist of base salary and bonus.

Base Salary. Base salaries for executive officers are determined in the same manner as those other salaried employees. Salary guidelines are established by comparing the responsibilities of the individual’s position in relation to similar positions in other nutraceutical companies of similar size. Individual salaries were determined this year by considering respective levels of responsibility, position and industry information.

Bonuses. In 2022, the Board established weighted performance targets for fiscal 2022 that it would consider in approving bonus payments for fiscal 2022. These targets included various corporate objectives related to regulatory milestones. In March 2023, the Compensation Committee determined that based on Company and individual performance targets, Mr. Payne should be awarded $175,000 and Mr. Marchiando should be awarded $50,505.

Equity Grants. On August 29, 2022, the Compensation Committee awarded Mr. Marchiando a grant of stock options under the 2021 Plan exercisable for 62,000 shares of Common Stock, at $3.94 per share. 15,500 shares underlying the stock option vested immediately, with 15,500 vesting on the first, second and third anniversaries of the date above. On December 16, 2022, the Compensation Committee awarded Mr. Payne 191,016 shares of Common Stock (the equivalent of approximately $450,000 worth; $400,000 owed to Mr. Payne pursuant to the Payne Contract (as described below) and $50,000 awarded to Mr. Payne in recognition of his forgoing any cost of living adjustment for 2023) of fully vested stock options under 2021 Plan, at an exercise price of $2.86 per share.

Employment Agreements

As of December 31, 2022, we had an employment agreement in place with our current President & Chief Executive Officer and our current Chief Financial Officer.

Mr. Payne’s Employment Agreement:

On February 15, 2022, the Company entered into a written agreement concerning Mr. Payne’s employment (the “Payne Contract”). Under the terms of the Payne Contract, Mr. Payne will serve as the Company’s President and Chief Executive Officer on an at will basis. Mr. Payne will receive an annual base salary, commencing on February 15, 2022, of $400,000. Mr. Payne is eligible for an annual performance bonus of no less than fifty percent (50%) but no more than one hundred twenty-five percent (125%) of Mr. Payne’s effective salary for the applicable bonus year.

If Mr. Payne’s employment is terminated for any reason by either the Company or Mr. Payne, Mr. Payne shall be entitled to receive the following: any accrued but unpaid Base Salary through the date of termination; reimbursement for unreimbursed expenses properly incurred by Mr. Payne prior to the date of termination; and such employee benefits, if any, to which Mr. Payne may be entitled under the Company’s employee benefit plans as of the date of termination.

On December 22, 2022, the Board approved an amendment to the Payne Contract (the “Payne Amendment”) modifying the terms of Mr. Payne’s Long Term Incentive Compensation (as defined in the Payne Amendment). Under the Payne Amendment, the Company shall award Mr. Payne that number of stock options pursuant to the 2021 Plan with an approximate value of $400,000 on the date of the grant, determined in accordance with, and subject to the terms and conditions of, the 2021 Plan and the applicable award agreement.

Mr. Marchiando’s Employment Agreement:

On January 1, 2021, the Company entered into an employment letter with Mr. Marchiando (the “Marchiando Agreement”). Under the terms of the Marchiando Agreement, Mr. Marchiando will serve as Chief Financial Officer of the Company for one year, with successive automatic renewals for one year terms, unless either party terminates the Marchiando Agreement on at least sixty days’ notice prior to the expiration of the then current term of the Marchiando Agreement. Mr. Marchiando will receive an annual base salary, commencing on January 1, 2021, of $280,000 (“Marchiando Base Salary”). The Marchiando Base Salary has increased to $300,000 one (1) year after the effective date, pursuant to the Company’s entering into a term sheet and receives the related financing to receive at least $10,000,000 in equity or other form of investment or debt (“Third Party Financing”) on terms satisfactory to the Company’s Board. Mr. Marchiando has also received $25,000 upon the closing, prior to December 31, 2021, of a Third Party Financing that raised at least $10,000,000. Mr. Marchiando has received the maximum bonus of $50,000, upon the closing prior to December 31, 2021 of a Third Party Financing that raised over $13,000,000 for the Company.

| 16 |

| Table of Contents |

If Mr. Marchiando’s employment is terminated by the Company due to death or Disability, or without Cause, or if Mr. Machiando resigns for Good Reason (each as defined in the Marchiando Agreement) or if either party does not renew the employment term, Mr. Marchiando will be entitled to receive the following severance benefits: a continuation of the Marchiando Base Salary for one year, payment of an amount equal to Mr. Marchiando’s target bonus in the year of termination and a fully-vested, nonqualified stock option to purchase 12,500 shares of Common Stock. Additionally, all outstanding and contingent nonqualified options owned directly or beneficially by Mr. Marchiando shall be converted immediately into vested options, with terms as specified in the applicable award agreement.

The Marchiando Agreement provides that if a Change of Control (as defined in the Marchiando Agreement) occurs and Mr. Marchiando resigns for Good Reason (as defined in the Marchiando Agreement) or Mr. Marchiando’s employment is terminated without Cause (as defined in the Marchiando Agreement) during the 24-month period following the Change of Control or during the sixty (60) days immediately preceding the date of a Change of Control, 100% of Mr. Marchiando’s unvested options will be fully vested and the restrictions on his restricted shares will lapse. The Marchiando Agreement also provides for severance payments of, amongst other things, a lump sum payment of 200% of the Marchiando Base Salary, 200% of Mr. Marchiando’s Performance Bonus (as defined in the Marchiando Agreement) earned in the last 12 months preceding the Change of Control and payment of 24 months of the Marchiando Base Salary in such event.

Mr. Dahl’s Employment Agreement:

Mr. Dahl served as our Chief Executive Officer until January 4, 2022. He previously served under the terms of an amended and restated employment agreement dated November 15, 2019 (“Dahl Agreement”) that superseded all prior employment agreements and understandings. Mr. Dahl received an annual base salary, commencing on June 1, 2019, of $440,000 (“Base Salary”), of which $7,500 per month was deferred until either of the following events occur: (i) within five (5) years after the effective date, the Company enters into a term sheet to receive at least $25,000,000 in equity or other form of investment or debt on terms satisfactory to the Board of the Company including funding at closing on such terms of at least $10 million; or (ii) within 12 months after the effective date that the Company receives revenue of at least $10 million. The Dahl Agreement was terminated in January 2022.

Outstanding Equity Awards at Fiscal Year-End 2022

The following table provides information on the outstanding equity awards held by our named executive officers as of December 31, 2022.

|

|

| Option Awards | |||||||||||||||

| Name |

| Grant Date |

| Number of securities underlying unexercised options exercisable |

|

| Number of securities underlying unexercised options unexercisable |

|

| Option / Warrant Exercise Price ($) |

|

| Option / Warrant Expiration Date | ||||

| John B. Payne |

| 10/12/2021 |

|

| 11,416 |

|

|

| - |

|

|

| 4.48 |

|

| 10/11/2031 | |

|

|

| 10/21/2021 |

|

| 192,000 |

|

|

| - |

|

|

| 5.50 |

|

| 10/20/2031 | |

|

|

| 12/16/2022 |

|

| 191,016 |

|

|

| - |

|

|

| 2.86 |

|

| 12/15/2031 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Keith R. Marchiando |

| 1/1/2021 | (1) |

| 84,375 |

|

|

| 78,125 |

|

|

| 11.20 |

|

| 12/31/2030 | |

|

|

| 10/25/2021 | (2) |

| 144,000 |

|

|

| 144,000 |

|

|

| 5.50 |

|

| 10/20/2031 | |

|

|

| 8/29/2022 | (2) |

| 15,500 |

|

|

| 46,500 |

|

|

| 3.94 |

|

| 8/28/2032 | |

| (1) | 37,500 shares underlying the stock option vested immediately, with 15,625 vesting every six months thereafter. |

|

|

|

| (2) | 25% vested upon acceptance of the grant, and 25% on each of the next three calendar anniversaries of the grant. |

| 17 |

| Table of Contents |

Non-Employee Director Compensation

In October 2021, our Board of Directors adopted a non-employee director cash and equity compensation plan. Under this policy, the Company agreed to pay each of its non-employee directors a cash stipend for service on its board of directors and, if applicable, on the Audit Committee, Compensation Committee and Nominating and Corporate Governance committee. Each of the Company’s non-employee directors receives an additional stipend for service as the chairperson of the compensation committee, nominating and corporate governance committee or audit committee or service as the non-executive chairperson. The stipends payable to each non-employee director for service on the Company’s Board of Directors are as follows:

|

|

| Member Annual Service Stipend(1) |

|

| Chairperson Additional Annual Service Stipend |

| ||

| Board of Directors |

| $ | 40,000 |

|

| $ | 5,000 |

|

| Audit committee |

|

| 4,000 |

|

|

| 2,000 |

|

| Compensation committee |

|

| 4,000 |

|

|

| 2,000 |

|

| Nominating and corporate governance committee |

|

| 4,000 |

|

|

| 2,000 |

|

| (1) | Chairs of each committee do not receive a stipend for being a member of the applicable committee. |

Each non-employee director is automatically granted a stock option to purchase shares of Common Stock with an approximate target value of $50,000 at the close of business on the date of each annual meeting. Such stock options will vest in four equal quarterly installments.

Non-Employee Director Compensation in 2022

The following table sets forth summary information concerning the compensation awarded to, paid to, or earned by the non-employee members of our board of directors for the fiscal year ended December 31, 2022:

| Name |

| Fees Earned or Paid in Cash ($) |

|

| Option Awards ($) (1) (2) |

|

| Total ($) |

| |||

| Nola E. Masterson |

|

| 60,308 |

|

|

| 58,365 |

|

|

| 118,673 |

|

| Christopher D. Maggiore |

|

| 57,742 |

|

|

| 58,365 |

|

|

| 116,107 |

|

| Alison A. Cornell |

|

| 68,384 |

|

|

| 358,365 |

|

|

| 426,749 |

|

| (1) | The amounts reported reflect the grant date fair value (excluding the effect of estimated forfeitures). The grant date fair value of each warrant is calculated using the Black Scholes option-pricing model computed in accordance with FASB ASC Topic 718 and do not correspond to the actual amount that will be realized upon exercise by the named Directors. Valuation assumptions used in determining the grant date fair value of 2022 awards are included in Note 11 of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 14, 2023. |

|

|

|

| (2) | Represents (i) options to purchase 15,797 shares of Common Stock granted to each non-employee director re-elected at the Company’s 2022 Annual Meeting of Shareholders on July 28, 2022 pursuant to its Non-Employee Director Compensation Policy; and (ii) options to purchase an additional 143,688 shares to Ms. Cornell, and 4,244 shares to Mr. Maggiore and Ms. Masterson in December 2022. |

| 18 |

| Table of Contents |

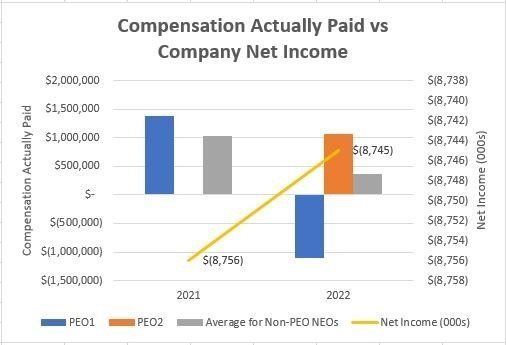

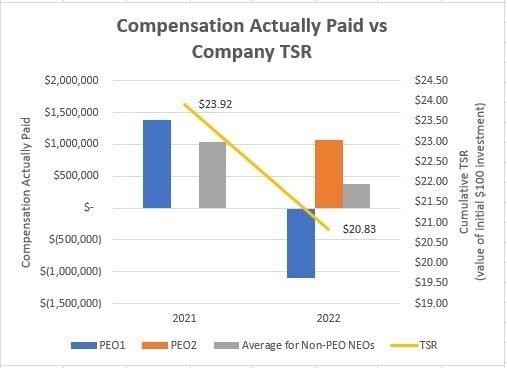

We are providing the following information about the relationship between executive compensation actually paid (CAP) and certain financial performance of the Company as required by SEC rules. Please see “Compensation Discussion and Analysis” for discussion of our compensation philosophy and how the Compensation and Talent Committee structures our compensation program to support our business objectives and align with our financial performance.

| Year |

| Summary Compensation Table Total for PEO 1 ($)(1) |

|

| Summary Compensation Table Total for PEO 2 ($)(1) |

|

| Compensation Actually Paid to PEO 1 ($)(1)(2) |

|

| Compensation Actually Paid to PEO 2 ($)(1)(3) |

|

| Average Summary Compensation Table Total for Non-PEO NEOs ($)(5) |

|

| Average Compensation Actually Paid to Non-PEO NEOs ($)(6) |

|

| Total Shareholder Return ($) |

|

| Net Loss ($ in thousands) |

| ||||||||

| 2022 |

|

| 4,368 |

|

|

| 1,022,753 |

|

|

| (1,104,373 | ) |

|

| 1,063,877 |

|

|

| 574,273 |

|

|

| 373,336 |

|

|

| 20.83 |

|

|

| (8,745 | ) |

| 2021 |

|

| 1,882,636 |

|

|

| N/A |

|

|

| 1,384,657 |

|

|

| N/A |

|

|

| 1,819,873 |

|

|

| 1,039,802 |

|

|

| 23.92 |

|

|

| (8,756 | ) |

_______________________________________________

| (1) | Andrew Dahl served as our principal executive officer (“PEO”) for the full year 2021 and from January 1, 2022 until his termination on January 7, 2022. Mr. Payne was appointed as Chief Executive Officer and became our PEO on January 8, 2022. |

|

|

|

| (2) | Amounts reported reflect CAP for Mr. Dahl, as computed in accordance with Item 402(v) of Regulation S-K, for each corresponding year, which amounts do not reflect the actual amount of compensation earned by or paid to Mr. Dahl during the applicable year. The adjustments below were made to Mr. Dahl’s total compensation for each year to determine the CAP for such fiscal year in accordance with the requirements of Item 402(v) of Regulation S-K. |

| Year |

| Reported Summary Compensation Table Total for PEO 1 ($) |

|

| Less |

|

| Reported Value of Equity Awards ($)(a) |

|

| Plus |

| Equity Award Adjustments ($)(b) |

|

| Equals |

| CAP for PEO 1 ($) |

| |||||

| 2022 |

|

| 4,368 |

|

|

| - |

|

|

| 0 |

|

| + |

|

| (1,108,741 | ) |

| = |

|

| (1,104,373 | ) |

| 2021 |

|

| 1,882,636 |

|

|

| - |

|

|

| 1,414,636 |

|

| + |

|

| 916,657 |

|

| = |

|

| 1,384,657 |

|

|

| (a) | Amounts reflect the grant date fair value of equity awards as reported in the “Option Awards” column in the Summary Compensation Table for the applicable year. No amounts were reported in the “Stock Awards” column in the Summary Compensation Table for any applicable year. |

|

|

|

|

|

| (b) | The equity award adjustments were calculated in accordance with Item 402(v) of Regulation S-K and include: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; (iii) for awards granted in prior years that vest in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value; and (iv) for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during the applicable year, a deduction for the amount equal to the fair value at the end of the prior fiscal year. The amounts deducted or added in calculating the equity award adjustments for Mr. Dahl are as follows: |

| Year |

| Year End Fair Value of Equity Awards Granted in the Year and Outstanding and Unvested at Year End ($) |

|

| Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards ($) |

|

| Value at the Vesting Date of Equity Awards Granted in Current Year ($) |

|

| Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions in the Year ($) |

|

| Total Equity Award Adjustments ($) |

| |||||

| 2022 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| (1,108,741 | ) |

|

| (1,108,741 | ) |

| 2021 |

|

| 899,487 |

|

|

| (308,212 | ) |

|

| 325,382 |

|

|

| 0 |

|

|

| 916,657 |

|

| (3) | Amounts reported reflect CAP for Mr. Payne, as computed in accordance with Item 402(v) of Regulation S-K, for 2022, which amounts do not reflect the actual amount of compensation earned by or paid to Mr. Payne. The adjustments below were made to Mr. Payne’s total compensation for each year to determine the CAP for such fiscal year in accordance with the requirements of Item 402(v) of Regulation S-K. |

| 19 |

| Table of Contents |

| Year |

| Reported Summary Compensation Table Total for PEO 2 ($) |

|

| Less |

|

| Reported Value of Equity Awards ($)(c) |

|

| Plus |

| Equity Award Adjustments ($)(d) |

|

| Equals |

| CAP for PEO 2 ($) |

| |||||

| 2022 |

|

| 1,022,753 |

|

|

| - |

|

|

| 449,999 |

|

| + |

|

| 491,123 |

|

| = |

|

| 1,063,877 |

|

|

| (c) | Amounts reflect the grant date fair value of equity awards as reported in the “Option Awards” column in the Summary Compensation Table for the applicable year. No amounts were reported in the “Stock Awards” column in the Summary Compensation Table for any applicable year. |

|

|

|

|

|

| (d) | The amounts deducted or added in calculating the equity award adjustments for Mr. Payne are as follows: |

| Year |

| Year End Fair Value of Equity Awards Granted in the Year and Outstanding and Unvested at Year End ($) |

|

| Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards ($) |

|

| Value at the Vesting Date of Equity Awards Granted in Current Year ($) |

|

| Change in Fair Value to the Vesting Date of Equity Awards Granted in Prior Years that Vested in the Year ($) |

|

| Total Equity Award Adjustments ($) |

| |||||

| 2022 |

|

| 0 |

|

|

| 0 |

|

|

| 449,999 |

|

|

| 41,124 |

|

|

| 491,123 |

|

| (5) | Reflects the average amount reported in the “Total” column of the Summary Compensation Table for our other NEOs as a group (excluding Messrs. Dahl and Payne) for each corresponding year. The names of each of the other NEOs (excluding Messrs. Dahl and Payne) included for purposes of calculating the average amounts in each applicable year are as follows: (i) for 2022, Mr. Keith Marchiando; and (ii) for 2021, Mr. Keith Marchiando and Phillip Rice. |

|

|

|

| (6) | Amounts reported reflect CAP for the other NEOs as a group (excluding Messrs. Dahl and Payne), as computed in accordance with Item 402(v) of Regulation S-K, for each corresponding year, which amounts do not reflect an average of the actual amount of compensation earned by or paid to the other NEOs as a group (excluding Messrs. Dahl and Payne) during the applicable year. The adjustments below were made to the average total compensation for the NEOs as a group (excluding Messrs. Dahl and Payne) for each year to determine the CAP for such year in accordance with the requirements of Item 402(v) of Regulation S-K. |

| Year |

| Average Reported Summary Compensation Table Total for Non-PEO NEOs ($) |

|

| Less |

|

| Average Reported Value of Equity Awards ($) |

|

| Plus |

| Average Equity Award Adjustments ($)(a) |

|

| Equals |

| Average CAP for Non-PEO NEOs ($) |

| |||||

| 2022 |

|

| 574,273 |

|

|

| - |

|

|

| 211,768 |

|

| + |

|

| 10,831 |

|

| = |

|

| 373,336 |

|

| 2021 |

|

| 1,819,873 |

|

|

| - |

|

|

| 1,586,206 |

|

| + |

|

| 806,135 |

|

| = |

|

| 1,039,802 |

|

|

| (a) | See note (b) to footnote (2) above for an explanation of the equity award adjustments made in accordance with Item 402(v) of Regulation S-K. The amounts deducted or added in calculating the total average equity award adjustments for the other NEOs as a group (excluding Messrs. Dahl and Payne) are as follows: |

| Year |

| Average Year End Fair Value of Equity Awards Granted in the Year and Outstanding and Unvested at Year End ($) |

|

| Year over Year Average Change in Fair Value of Outstanding and Unvested Equity Awards ($) |

|

| Value at the Vesting Date of Equity Awards Granted in Current Year ($) |

|

| Average Change in Fair Value to the Vesting Date of Equity Awards Granted in Prior Years that Vested in the Year ($) |

|

| Total Average Equity Award Adjustments ($) |

| |||||

| 2022 |

|

| 95,034 |

|

|

| (145,553 | ) |

|

| 52,940 |

|

|

| 8,410 |

|

|

| 10,831 |

|

| 2021 |

|

| 381,996 |

|

|

| - |

|

|

| 424,139 |

|

|

| - |

|

|

| 806,135 |

|

Analysis of Information Presented in the Pay Versus Performance Table

The Company is providing the following descriptions of the relationships between information presented in the Pay versus Performance table, including CAP, as required by Item 402(v) of Regulation S-K. The Compensation and Talent Committee utilizes several performance measures to align executive compensation with Company performance, and only some of those Company measures are presented in the Pay versus Performance table above and the graphs below.

| 20 |

| Table of Contents |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS

The following table sets forth certain information regarding each person who is known to us to beneficially own more than 5% of our issued and outstanding shares of Common Stock, and the number of shares of our Common Stock beneficially owned by each of our directors and named executive officers, and all officers and directors as a group. All percentages are based on 9,419,660 shares of Common Stock issued and outstanding as of March 1, 2023, and where applicable, beneficial ownership includes shares which the beneficial owner has the right to acquire within 60 days.

Security Ownership of Certain Beneficial Owners:

| Name and Address |

| Number of Shares Beneficially Owned (1) |

|

| % of Class |

| ||

| HEP Investments, LLC 2804 Orchard Lake Rd. Suite 205 Keego Harbor, MI 48302 |

|

| 1,751,900 | (2) |

|

| 12.1 | % |

|

|

|

|

|

|

|

|

|

|

| Mark E. Strome 1688 Meridian Ave, Suite 727 Miami Beach, FL 33139 |

|

| 657,536 | (3) |

|

| 4.5 | % |

|

|

|

|

|

|

|

|

|

|

| Christopher D. Maggiore 4788 Nobles Pond Dr. NW Canton, OH 44718 |

|

| 975,795 | (4)(5)(6) |

|

| 6.8 | % |

Security Ownership of Management:

| Name |

| Number of Shares Beneficially Owned (1) |

|

| % of Class |

| ||

| Christopher D. Maggiore |

|

| 975,795 | (4)(5)(6) |

|

| 6.8 | % |

| Andrew A. Dahl |

|

| 83,324 | (7) |

| * |

| |

| John B. Payne |

|

| 541,333 | (8) |

|

| 3.7 | % |

| Keith R. Marchiando |

|

| 259,500 | (9) |

|

| 1.8 | % |

| Nola E. Masterson |

|

| 77,456 | (10) |

| * |

| |

| Alison A. Cornell |

|

| 201,612 | (11) |

| * |

| |

| All Current Directors and Officers as a Group (5 persons) |

|

| 2,055,620 | (12) |

|

| 13.4 | % |

* Less than 1%

| (1) | Beneficially owned shares, as defined by the SEC, are those shares as to which a person has voting or investment power, or both, and which the beneficial owner has the right to acquire within 60 days. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them. “Beneficial” ownership does not necessarily mean that the named person is entitled to receive the dividends on, or the proceeds from the sale of, the shares. |

|

|

|

| (2) | Includes 295,487 shares of Common Stock issuable upon the exercise of certain warrants. Laith Yaldoo, the manager and controlling member of HEP Investments, LLC, may be deemed to have voting and dispositive power over the shares held by HEP Investments. |

|

|

|

| (3) | Represents shares held by Strome Mezzanine Fund, L.P. (“Strome Mezz”), Mark E. Strome, Strome Alpha Fund, L.P. (“Strome Alpha”), and Strome Investment Management, L.P. (“Strome Investment,” and together with Strome Mezz and Strome Alpha, “Strome Group”), the general partner of each of the entities in the Strome Group is Mark E. Strome. Includes 331,250 shares of Common Stock issuable upon the exercise of certain warrants. Mark E. Strome, the sole director, president, and chief executive officer of Strome Group, may be deemed to have voting and dispositive power over the shares held by Strome. |

|

|

|

| (4) | Pursuant to a Schedule 13D/A filed with the SEC on February 14, 2023, Christopher D. Maggiore has sole power to vote 898,285 shares, sole power to dispose 898,285 shares, shared power to vote 81,459 shares and shared power to dispose 81,459 shares. |

|

|

|

| (5) | Includes options to purchase 69,508 shares of Common Stock and warrants to purchase 101,546 of Common Stock. |

|

|

|

| (6) | Includes 81,459 beneficial shares held in the estate of the Robert S. McLain Estate of which Mr. Maggiore is the controlling trustee. |

|

|

|

| (7) | Includes warrants to purchase 75,000 shares of Common Stock. Mr. Dahl’s position as an executive officer of the Company ended in January 2022. |

|

|

|

| (8) | Includes options to purchase 394,432 shares of Common Stock and warrants to purchase 137,500 of Common Stock. |

|

|

|

| (9) | Includes options to purchase 259,500 shares of Common Stock. |

|

|

|

| (10) | Includes options to purchase 53,432 shares of Common Stock and warrants to purchase 18,750 of Common Stock. |

|

|

|

| (11) | Includes options to purchase 174,612 shares of Common Stock. |

|

|

|

| (12) | Includes options to purchase 951,484 shares of Common Stock and warrants to purchase 257,796 of Common Stock. |

| 21 |

| Table of Contents |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Policies and Procedures for Related Party Transactions